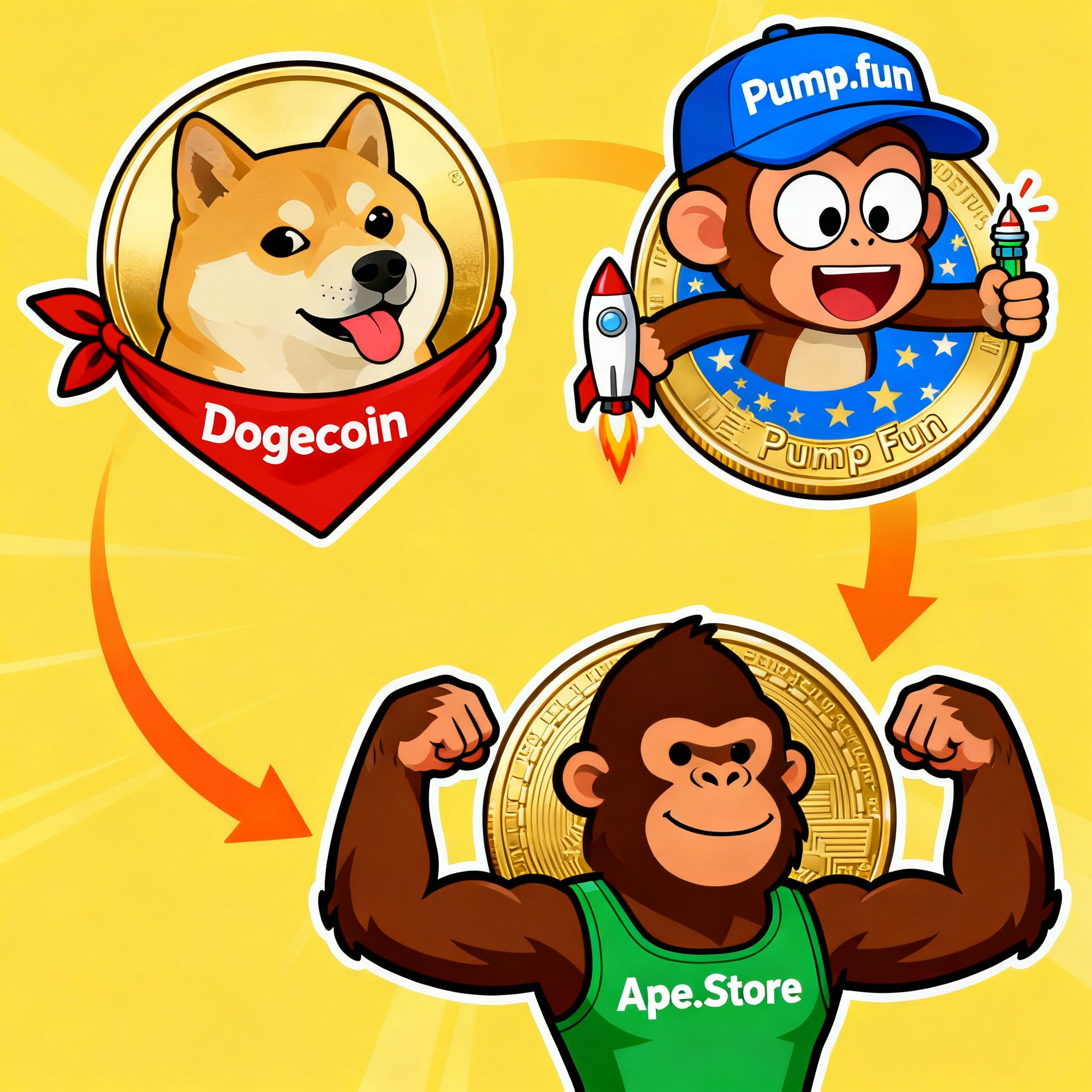

The journey of meme coins is a fascinating saga of crypto culture, community dynamics, and evolving technology. From Dogecoin’s humble beginnings to the explosive growth on Pump.fun, and now to the maturing ecosystem on Ape.Store, meme coins have experienced distinct cycles that reflect broader shifts in the cryptocurrency landscape. Understanding these cycles helps traders and creators navigate the hype, risks, and opportunities of the meme coin economy in 2025.

The Genesis: Dogecoin and the Birth of Meme Culture

Dogecoin was the original meme coin, launched in 2013 as a parody cryptocurrency. It combined humor, internet culture, and a friendly community spirit, and unintentionally became a pioneering force in decentralized finance.

Dogecoin’s Key Features:

- Early viral virality: Leveraged internet memes, Reddit, and Twitter communities.

- Low price: Initially fractions of a cent, encouraging mass adoption.

- Limited utility: Primary purpose was fun and tipping, with little real DeFi integration.

- Slow ascent: Growth was steady but accelerated dramatically during 2020-2021 hype cycles.

- Community-driven success: Supported by grassroots campaigns like the Doge meme as a symbol for fun.

Dogecoin’s significance lies not in its technology or utility but in proving that online social sentiment and community spirit can drive unprecedented crypto market growth.

The Boom: Pump.fun and Solana’s Memecoin Frenzy

As blockchain technology matured, meme coins exploded onto Solana via Pump.fun, a launchpad designed to simplify token creation with bonding curves and viral mechanics.

Characteristics of the Pump.fun Cycle:

- Rapid launches: Over 13,000 tokens launched daily by 2025.

- Massive speculative volume: Price explosions and dumps driven by speculative traders hungry for quick gains.

- Low entry barrier: Launch costs under $1 enabled thousands of experiments, including scams and high-risk ‘shitcoins’.

- Highly volatile trading: Extreme pumps and dumps, often within hours or days.

- Network effect: Earlier arrival on Solana enabled its dominance and viral growth.

Pump.fun embodied the high-octane, low-friction meme coin culture, facilitating explosive growth but emphasizing short-term speculation over sustainability.

The Dark Side:

- High failure rates: 98.6% of tokens lose liquidity and value rapidly.

- Scam prevalence: Rug pulls and honeypots were routine risks.

- Market saturation: Billions of tokens launched leading to discoverability issues.

- Volatility fatigue: Traders faced emotional swings and massive losses.

The Evolution: Ape.Store and the Rise of Layer 2 Stability

In response to Pump.fun’s chaos, Ape.Store emerged on the Base blockchain (an Ethereum Layer 2), offering more structured, transparent, and security-conscious memecoin launches.

Ape.Store’s Defining Traits:

- Selective scale: Smaller launch volume (~500-2,000 daily), improving signal-to-noise.

- Trust-minimized liquidity: Automates liquidity locking and LP token burning to prevent rug pulls.

- Automatic Uniswap v2 listings: Facilitating migration to broader, decentralized markets.

- Ethereum integration: Builds projects compatible with mainstream DeFi, enhancing legitimacy.

- Emphasis on community quality: Targets creators and traders interested in longer-term sustainability.

Ape.Store represents meme coin culture’s shift toward maturity, where sustainability, security, and ecosystem integration become priorities over pure speculation.

Benefits Over Previous Cycles:

- Lower noise leads to better discoverability.

- Stronger liquidity protections build investor confidence.

- Institutional-grade infrastructure from Ethereum L2 opens new capital avenues.

- Automatic listing and transparent contracts reduce manual manipulations.

Understanding Meme Coin Cycles: Lessons from Each Era

| Era | Core Features | Advantages | Drawbacks |

|---|---|---|---|

| Dogecoin Era (2013-2019) | Community-driven, novelty | Pioneer of meme culture, grassroots | Limited utility, slow growth |

| Pump.fun Era (2021-2025) | Viral launches, mass speculation | Explosive gains, easy token creation | High failure, scams, volatility fatigue |

| Ape.Store Era (2025-present) | Layer 2 security, liquidity locking | Enhanced trust, sustainability | Smaller scale, slower viral growth |

Practical Implications for Traders and Creators

- Early Dogecoin adopters: Benefited from novelty and rising crypto awareness.

- Pump.fun traders: Need to navigate high risk for potential rapid rewards.

- Ape.Store participants: Focus on vetting projects, community health, and long-term holding potential.

FAQ

Can meme coins be sustainable investments?

Historically, few have been. Ape.Store aims to break this trend through transparency and liquidity protections, but speculative risk remains high.

Is Pump.fun dead?

No. It remains the market leader in volume but represents the high-risk, short-term speculation zone.

Will Ape.Store replace Pump.fun?

Not fully; both coexist serving different trader profiles—Pump.fun for rapid speculation, Ape.Store for longer-term engagement.

Conclusion

The meme coin market has evolved from Dogecoin’s viral novelty, through Pump.fun’s speculative frenzy, to Ape.Store’s emerging maturity on Ethereum Layer 2. Each cycle reflects shifts in market psychology, technology, and trader sophistication.

Understanding these cycles helps traders and creators align their strategies with the platform and culture best suited to their goals—whether chasing quick gains or building lasting communities.

Appreciating these nuanced differences is critical in navigating the dynamic and often volatile world of meme coins in 2025 and beyond.