Category: Blockchain & Meme Basics

-

The Future of Meme Launchpads: Base vs Solana vs Next L2

The memecoin launchpad ecosystem is at an inflection point. Solana’s dominance through Pump.fun is challenged by Base’s institutional backing and professional infrastructure. Simultaneously, emerging Layer 2 solutions (Arbitrum, Optimism, Polygon) are entering the memecoin space. This competition will determine the future trajectory of memecoin markets. Understanding the strategic positioning of each platform—their technical advantages, regulatory…

-

Meme Coins and Regulations: Risks for Creators and Traders

The regulatory landscape surrounding cryptocurrencies remains turbulent and ambiguous. For memecoin creators and traders, this uncertainty creates significant legal and financial risks. Unlike established cryptocurrencies with years of regulatory precedent, meme coins occupy a gray zone where regulators are actively developing enforcement approaches. Understanding regulatory risks—what they are, how they’re enforced, and how different platforms…

-

The Psychology of FOMO in Meme Launchpads

The Psychology of FOMO in Meme Launchpads: Understanding Impulse, Risk, and Decision-Making Fear of missing out (FOMO) is the primary driver of memecoin trading. It’s the psychological force that transforms rational traders into impulsive buyers, turns casual observers into frantic participants, and ultimately determines success or failure for most retail traders. Understanding FOMO—how it operates,…

-

What Makes a Meme Sustainable? Tokenomics Case Studies

Meme coins have a reputation for being disposable—tokens that spike overnight and evaporate within weeks. Yet some meme coins defy this pattern, maintaining communities and trading activity for months or years. The difference between flash-in-the-pan projects and sustainable tokens rarely comes down to the meme itself. Instead, it’s tokenomics—the economic structure underlying the token—that determines whether…

-

Understanding Liquidity Pools: Ape.Store’s Auto-LP vs Pump.fun

Understanding Liquidity Pools Liquidity pools are the backbone of decentralized trading. For memecoin traders and creators, understanding how liquidity pools work—and specifically how Ape.Store’s automatic liquidity mechanism differs from Pump.fun’s approach—is essential for making informed decisions about token launches and trading strategies. This guide explains liquidity pools, compares the two major platforms, and reveals why…

-

From Explorer to Token Page: How to Research Safely

From Explorer to Token Page: How to Research Meme Coins Safely In the memecoin ecosystem, due diligence is the difference between finding legitimate projects and losing capital to scams. With thousands of tokens launching daily, the ability to research tokens methodically—using block explorers, verified information sources, and analytical tools—is essential. This guide walks through the…

-

Virtual Liquidity Explained with Ape.Store Examples

Virtual Liquidity Explained: How Bonding Curves Work with Ape.Store Examples Virtual liquidity is one of the most misunderstood concepts in cryptocurrency, yet it’s fundamental to how modern token launchpads operate. Understanding virtual liquidity—and how platforms like Ape.Store leverage it—is essential for anyone participating in memecoin trading or token launches. This guide explains the mechanics, advantages,…

-

Meme Coin Cycles: From Dogecoin to Pump.fun to Ape.Store

The journey of meme coins is a fascinating saga of crypto culture, community dynamics, and evolving technology. From Dogecoin’s humble beginnings to the explosive growth on Pump.fun, and now to the maturing ecosystem on Ape.Store, meme coins have experienced distinct cycles that reflect broader shifts in the cryptocurrency landscape. Understanding these cycles helps traders and…

-

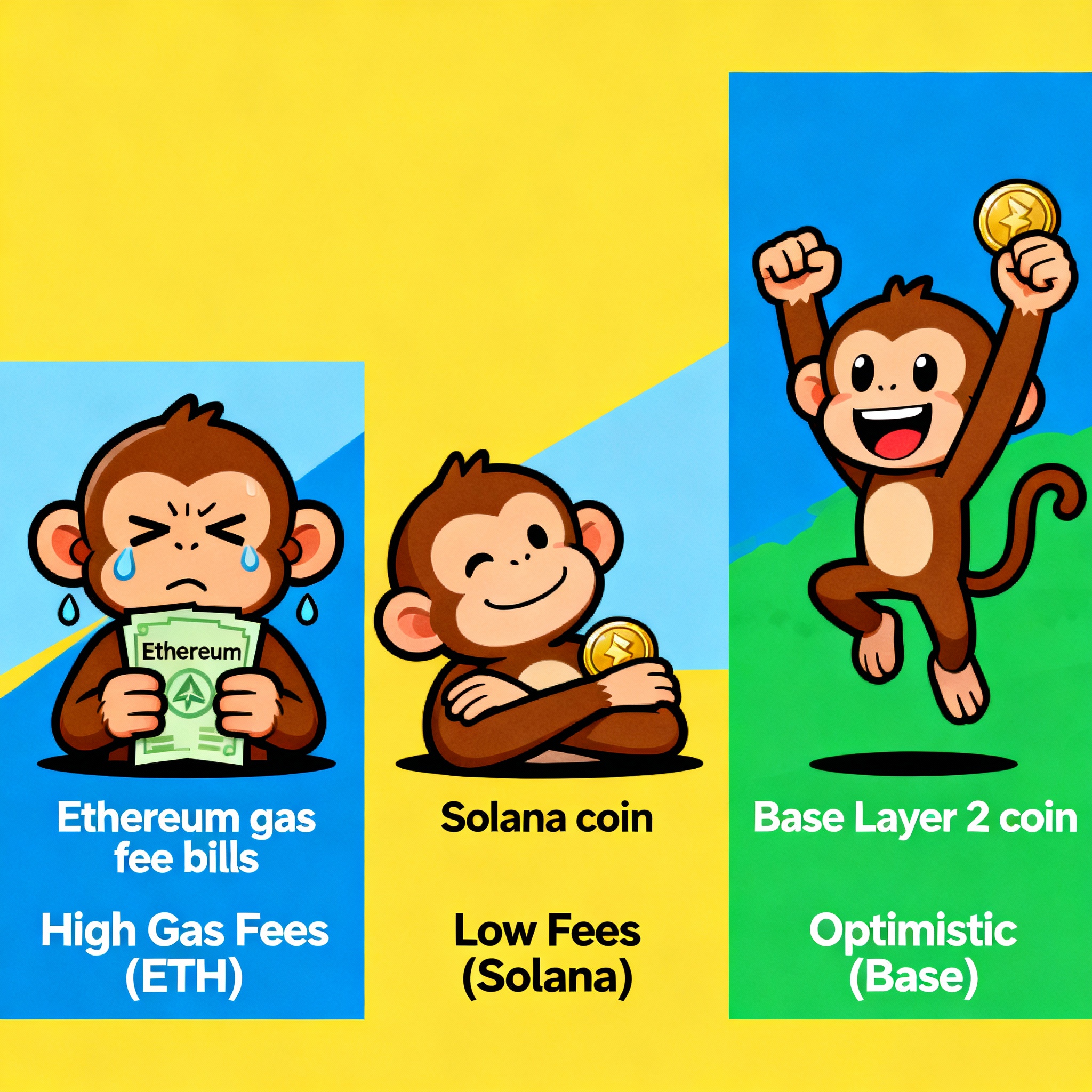

How Gas Fees Affect Meme Traders: ETH vs Solana vs Base

Gas fees are the invisible tax on every cryptocurrency transaction. For memecoin traders executing hundreds of trades monthly, gas fees transform from minor inconvenience to major cost factor—sometimes determining profitability. This analysis examines how gas economics actually impact traders across Ethereum mainnet, Solana, and Base, revealing surprising truths about what “cheap gas” actually means for…

-

Why Layer 2 (Base) Is Becoming the Home for Memecoins

The Shift Nobody Expected For years, Solana dominated memecoin culture. Fast, cheap, and community-driven, it seemed like the natural home for speculative tokens and viral projects. But in 2025, something unexpected is happening: Layer 2 solutions—particularly Base—are quietly becoming the preferred infrastructure for serious memecoin projects. This shift isn’t about technology. It’s about economics, ecosystem…