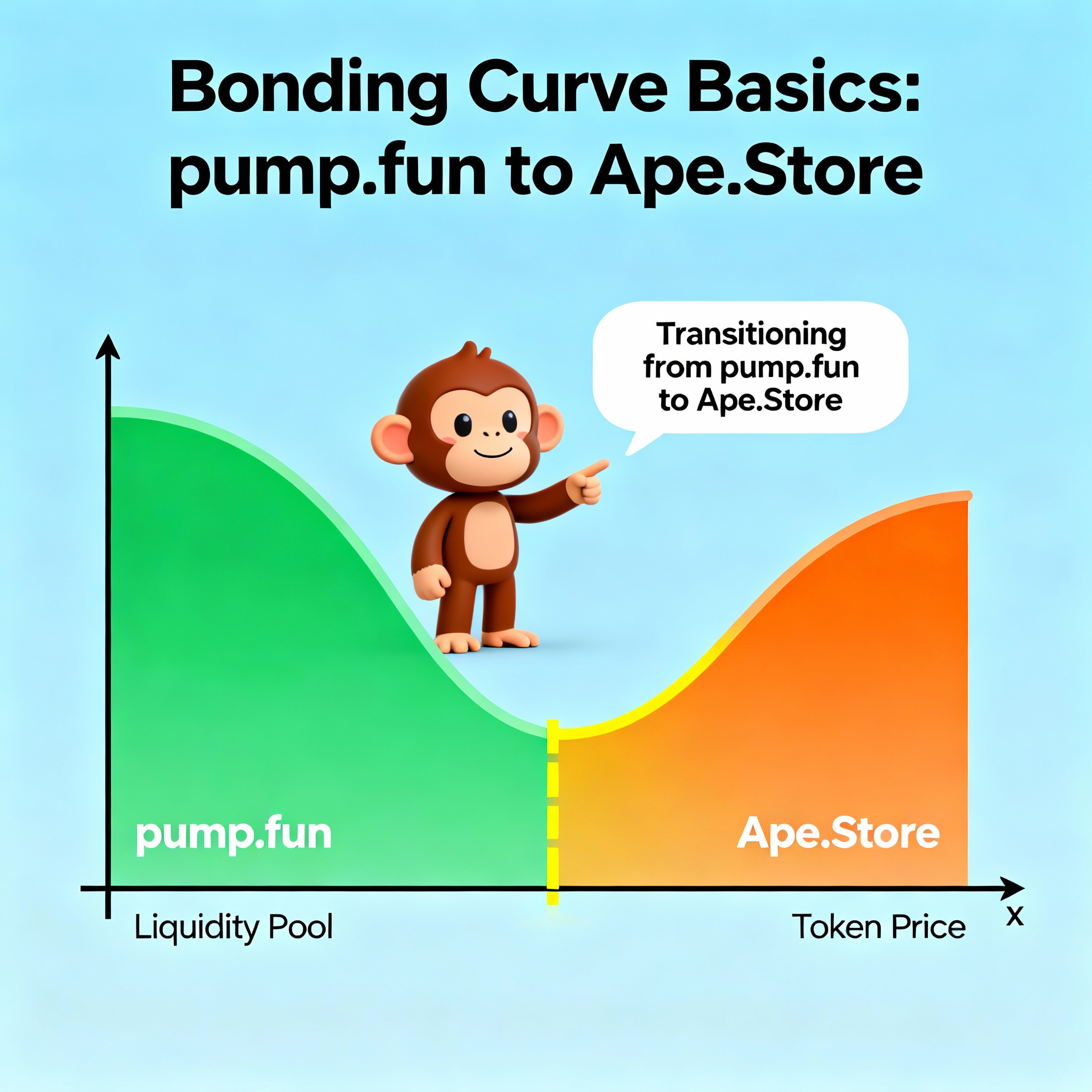

If you’ve explored meme coin launchpads or participated in token launches on platforms like Pump.fun or Ape.Store, you’ve encountered bonding curves. Understanding how they work clarifies token pricing mechanics and explains why these platforms function so differently from traditional exchanges.

What Is a Bonding Curve?

A bonding curve is a mathematical formula that automatically determines a token’s price based on circulating supply. The core principle is simple: price is a function of supply.

- More tokens in circulation → Higher prices for new purchases

- Fewer tokens in circulation → Lower prices for new purchases

This creates an automated pricing mechanism that doesn’t require external market participants (market makers or traders) to establish prices. Instead, a smart contract executes the formula for every transaction.

How It Works: Step by Step

- You’re the first buyer → Supply is minimal, so the curve price is lowest

- More buyers join → Each purchase mints new tokens at incrementally higher prices according to the curve formula

- Someone sells → Sold tokens are returned to the contract, supply decreases, and prices adjust downward along the curve

- Ongoing trading → Price continuously adjusts based on live supply changes

Visual Concept

Imagine a staircase where each step up represents the price someone pays for 100 tokens:

- Step 1 ($0.001): First buyer gets 100 tokens

- Step 2 ($0.002): Next buyer pays 2x more

- Step 3 ($0.005): Next buyer pays 5x more

- And so on…

As supply climbs, prices accelerate according to the curve formula.

How Bonding Curves Function on Pump.fun and Ape.Store

Pump.fun (Solana)

Pump.fun uses a specific bonding curve formula with the following properties:

- Fixed Supply: 1 billion tokens per launch

- Curve Formula: y = 1,073,000,191 – 32,190,005,730/(30+x), where x = SOL purchased

- Entry Price: Extremely low (fractions of a cent)

- Price Acceleration: Prices increase quadratically as supply grows

- Graduation Threshold: At ~$69,000 market cap, liquidity automatically migrates to Raydium (Solana DEX) and LP tokens burn

Result: Massive early buyer advantage; late buyers face exponentially higher prices, creating strong incentives for early participation and rapid hype cycles.

Ape.Store (Base)

Ape.Store implements similar bonding curve principles with claimed additional features:

- Curve Mechanics: Tokens progress through bonding curve with algorithmically determined pricing

- Automatic Listing: Platform claims automatic migration to Uniswap v2 at specified market cap thresholds (exact parameters not comprehensively documented)

- Liquidity Security: Reported LP token burning prevents liquidity withdrawal (needs verification)

- Base Integration: Leverages Ethereum Layer 2 for settlement and ecosystem compatibility

Note: Specific curve formula and threshold mechanics for Ape.Store are not publicly detailed, making direct comparison with Pump.fun difficult.

Why Bonding Curves Matter in Crypto

Guaranteed Liquidity

Traditional exchanges require matching buyers and sellers. Bonding curves guarantee execution at all times because the formula always defines a price. You can buy or sell any amount (though slippage increases with size).

Transparent, Algorithm-Driven Pricing

Prices follow public, immutable formulas embedded in smart contracts. This reduces—though doesn’t eliminate—manipulation possibilities because:

- Price calculations are deterministic

- Anyone can verify prices independently

- Human discretion is removed from pricing decisions

Equal Access, Unequal Pricing

Everyone can participate in bonding curves at any time. However, timing creates asymmetric outcomes:

- Early buyers pay exponentially less

- Late buyers pay exponentially more

- This isn’t “unfair” in terms of access, but creates meaningful price asymmetry

Minimal Friction

Token launches require no market makers, order books, or exchange infrastructure. A single smart contract handles all pricing and execution.

Types of Bonding Curves and Their Effects

Bonding curves come in different mathematical forms, each with distinct pricing behaviors:

| Curve Type | Characteristics | Effect |

|---|---|---|

| Linear | Price increases uniformly (e.g., +$0.01 per token) | Steady, predictable price growth |

| Exponential/Quadratic | Price accelerates as supply grows | Aggressive early-buyer advantage |

| Sigmoidal | Slow start → rapid middle → plateau | Moderate incentive for early entry |

Pump.fun uses exponential-like curves, creating dramatic price acceleration. Early buyers might pay $0.001 per token; by 500M tokens sold, prices could be $100+.

Ape.Store’s specific curve type is not documented, making comparative analysis difficult.

Illustrative Example

Token Launch with Exponential Bonding Curve:

| Supply Milestone | Price Per Token | Cost to Buy 100,000 Tokens |

|---|---|---|

| 0-100M tokens (you’re early) | $0.001 | $100 |

| 500M tokens (mid-phase) | $0.50 | $50,000 |

| 900M tokens (late phase) | $10.00 | $1,000,000 |

This extreme example illustrates why early participation in exponential curves creates massive returns—and why late participants face significant losses without strong project fundamentals.

FAQ

What’s the main benefit of bonding curves?

Automatic pricing and guaranteed liquidity without requiring external market participants. Anyone can buy or sell at mathematically defined prices any time.

Can bonding curve token prices go down?

Yes. If selling volume exceeds buying volume, supply decreases and prices move downward along the curve. Bonding curves aren’t one-directional; they respond to actual supply changes.

Are bonding curves only for meme coins?

Primarily, yes—Pump.fun and Ape.Store popularized them for memecoin launches. However, the mechanic theoretically applies to any token ecosystem needing automatic pricing. Very few traditional DeFi projects use bonding curves.

How do platforms prevent manipulation of bonding curves?

By encoding logic in immutable smart contracts. However, this doesn’t prevent:

- Platform designers choosing curve formulas that favor early buyers

- Wash trading to artificially move prices

- Bot activity exploiting price differences

- Smart contract bugs or exploits

What happens to bonding curve tokens after graduation?

When tokens graduate to DEXs (e.g., Pump.fun → Raydium), the bonding curve typically closes or becomes inactive. Trading shifts to the DEX where prices are determined by market supply-demand, not algorithmic curves. LP tokens are usually burned to prevent liquidity withdrawal.

How does slippage work on bonding curves?

Buying 100 tokens might execute at one price, but buying 100,000 tokens will execute across multiple points of the curve at incrementally higher prices. The larger your trade relative to current supply, the higher average price you pay—this is slippage.

Conclusion

Bonding curves are powerful tools for creating instant liquidity and transparent pricing in token launches. Platforms like Pump.fun and Ape.Store leverage them to enable anyone to launch tokens in minutes without traditional exchange infrastructure.

However, bonding curves introduce significant asymmetries:

- Early buyers benefit enormously from exponentially lower prices

- Late buyers face severe disadvantages in price terms

- Success depends on project fundamentals, not just curve mechanics

Understanding bonding curves helps you recognize why early participation in meme coin launches carries both appeal and risk. The mathematical advantage of early entry is real, but it doesn’t guarantee profitability if project communities don’t sustain interest or development.

For launchpad users, bonding curves democratize token creation; for traders, they explain why timing matters so dramatically in memecoin markets.